Your 2026 Guide to Medicare Premiums

Understanding what you can expect to pay in Medicare premiums can help you better prepare for your health care expenses.

The various parts of Medicare come with differing premiums—some are optional, some are required, and some can change based on your income level.

Before we dive into premiums, let’s review some of the basics. The first thing to know is that Medicare is divided into four parts:

Most individuals qualify for Part A and Part B upon turning 65, so long as they or their spouse worked at least 10 years and paid into Social Security taxes. Parts A and B are considered “Original Medicare.”

Part C (also called Medicare Advantage) combines Parts A, B, and typically D into one plan. Medicare Part D covers prescription drugs. Parts C and D are additional coverage that you can purchase to enhance Original Medicare. While Medicare Parts A and B are offered by federal and state governments, private insurance companies offer Part C and Part D plans.

Each of Medicare’s parts can come with premiums, or monthly payments, which may be conditional or mandatory.

Note: All figures listed here are based on 2026 data.

Original Medicare: Part A and Part B

Medicare Part A covers inpatient care: hospitalizations, skilled nursing care, hospice, and some home health care. Medicare Part A is premium-free—for most people. If you or your spouse have worked at least 10 years (40 quarters) by the time you turn 65, you receive Medicare Part A at no monthly cost. However, if you or your spouse have worked less than 10 years, you can purchase Part A with a premium of up to $565 each month per individual.

While most people may not pay a monthly premium for Medicare Part A, it is not free. You still pay out-of-pocket costs for medical services.

If you do have to pay for your Part A premium, potential enrollment penalties can increase your monthly Part A costs. If you don’t purchase Medicare Part A when you are first eligible, your monthly premium can go up 10 percent. This applies for twice the number of years you could have had Part A but didn’t enroll. For example, if you didn’t sign up for Medicare Part A for two years after you were eligible, your premium would be 10 percent higher for four years. After paying penalties for four years, the premium would go back down to your standard monthly rate. Part A penalties do not apply to individuals who qualify for premium-free Part A. Learn more about late enrollment penalties.

Medicare Part B covers essential health services and supplies, as well as preventive care, including ambulance services, health screenings, and medical equipment. Unlike Part A, every Medicare beneficiary pays a monthly premium for Part B, except for those who are eligible for full Medicaid, as Medicaid may cover their Part B premium.

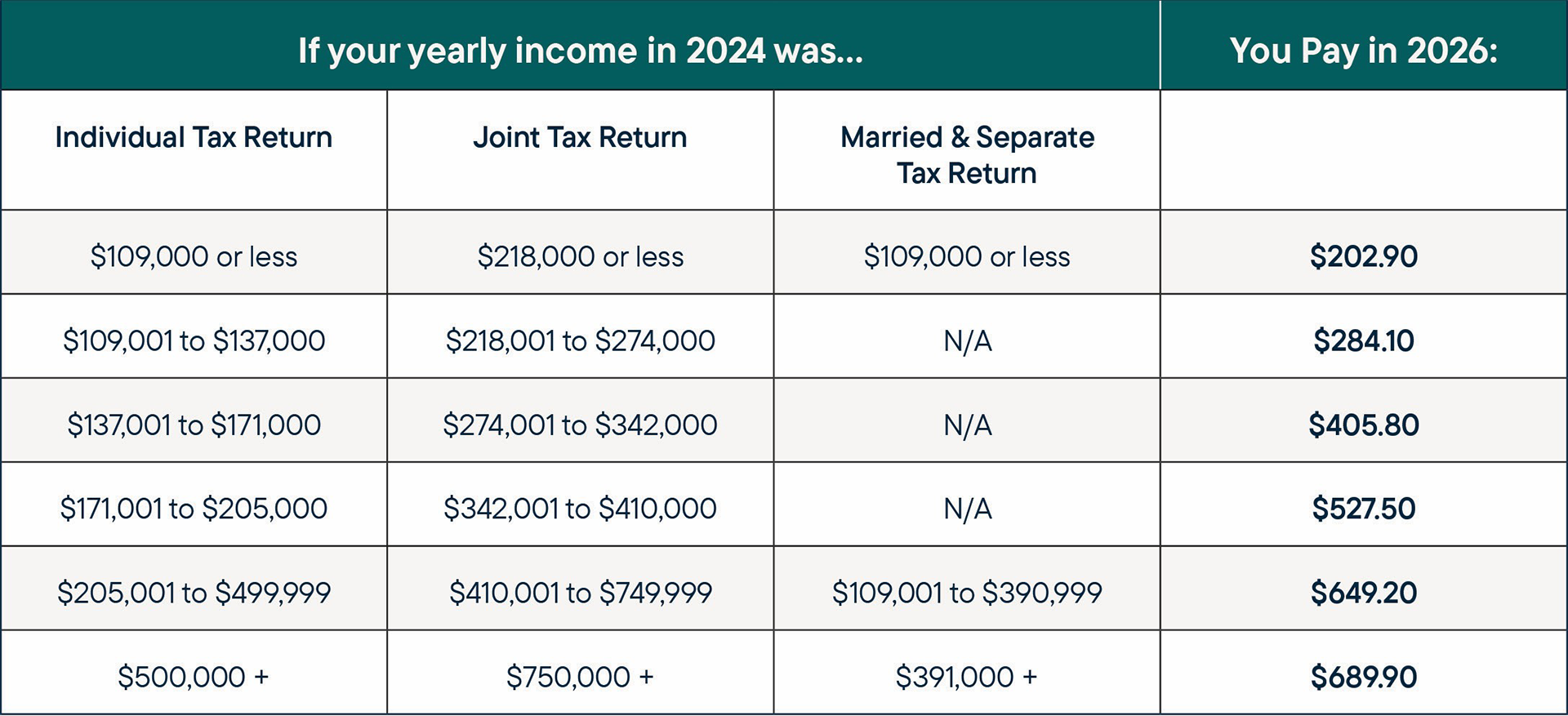

Your Medicare Part B premium cost is determined by your annual income from two years prior and your tax filing status. The table below breaks down Medicare Part B premiums for 2026.

Even if you and your spouse file a joint tax return, each of you will pay an individual monthly premium for Part B, as all Medicare parts and plans are considered individual coverage. If you have a qualifying life event, such as an end to or reduction in your employment, you may be able to submit an appeal to reduce your income surcharge.

Late enrollment penalties can also apply to Medicare Part B, unless you have been covered by an active employer health plan from the time you were first eligible for Part B (usually the first of the month in which you turned 65). If you wait too long to sign up for Medicare Part B, you can incur a 10 percent premium increase for each 12-month period you were eligible but did not enroll. For example, if you wait until 24 months after your eligibility ends, that totals two 12-month periods without coverage. As a result, your monthly premium would increase by 20 percent (10 percent per period x two 12-month periods) for the duration of your Part B coverage.

Additional Coverage: Medicare Part C and Part D

Medicare Part C, commonly referred to as Medicare Advantage, is an option that can be purchased alongside Original Medicare. Medicare Advantage plans combine the benefits of Part A and Part B, and they often include prescription drug coverage (Part D) as well as additional services not offered by Original Medicare.

The amount you pay for this kind of plan varies based on the plan you select and the benefits it includes. Reach out to our team for help assessing all your plan options. We’ll keep your current health care needs and expenses in mind as we research available coverage.

You can also purchase prescription drug coverage (Part D) in addition to Original Medicare. Standalone Part D plans have a monthly premium. You can save on this monthly premium, however, when you purchase a Medicare Part C plan that includes Part D coverage.

FAQS: Medicare Premiums

Does Medicare Part A have a monthly premium?

Usually not. It depends on your work history. But if you or your spouse have paid into Social Security taxes for at least 10 years, your Medicare Part A premium is waived.

Does Medicare Part B have a monthly premium?

Yes. For most people, it’s $202.90, but it can be more based on your income. See the chart above.

What if my income changes? Will it change my Part B monthly premium?

Your Part B premium is calculated based on your taxable income from two years prior—for example, your 2026 rates are calculated based on your 2024 income. At the end of each year, you will receive a notice of your Part B premium for the next year based on your modified adjusted gross income (MAGI) from 2 years earlier. Once retired, most people will not see changes in their premium amounts beyond the annual inflationary increases, but it is possible if your MAGI changes from year to year. You may have the option to appeal any income-related surcharges if you have had a qualifying life event.

Does Medicare Part C (Medicare Advantage) have a monthly premium?

Potentially, depending on the plan you choose. Regardless, you must continue to pay your Part B premium. When you use Medicare Advantage services, you pay copays, coinsurance, and possibly deductibles.

Does Medicare Part D have a monthly premium?

Standalone Part D plans may have a monthly premium, depending on the plan. You can bypass paying a separate Part D premium if your Part C plan includes prescription drug coverage.

What is the premium for a Medicare Supplement plan?

Medicare Supplement (Medigap) premium rates vary by insurance carrier. Rates are determined by your age, gender, where you live, and when you enroll.

Want to learn more about Medicare premiums?

Whether you have questions about monthly premiums or choosing the right Medicare plan, we’re here for you!

Share this article: