What is Medicare Part B?

Medicare Part B is part of Original Medicare and is sometimes referred to as "medical insurance." We cover everything you need to know - from Medicare Part B 2026 costs, coverage, and eligibility.

The Four Parts of Medicare

Medicare consists of four basic parts: Part A, Part B, Part C, and Part D. Generally, the different parts of Medicare help cover specific services. Depending on your situation, you can get Medicare coverage through a combination of these parts. Our advisors can help determine the combination of these four parts that is right for you.

What does Medicare Part B cover?

Part B generally covers two types of medical services. First, Medicare Part B covers medically necessary health services and supplies. Second, Part B covers preventive services.

- Physician services

- Outpatient hospital services

- Certain home health services

- Tests

- Wheelchairs and walkers

- Clinical research

- Ambulance services

- Durable medical equipment (DME)

- Mental health services (inpatient and outpatient)

- Limited outpatient prescription drugs

- Screenings

- Annual wellness exams

A more exhaustive list for Medicare Part B coverage, can be found on Medicare.gov.

What does Medicare Part B cost?

Medicare Part B has three associated costs: an annual deductible, a monthly premium, and coinsurance for covered medical services.

Medicare Part B costs for 2026:

- Annual deductible: $283

- Monthly premium: $202.90 (for most Medicare enrollees)

- Coinsurance: 20 percent of the total cost of the Medicare allowed amount (for covered services)

After the deductible is met, you typically pay 20% of the Medicare allowed amount for covered services, and Medicare pays for the rest. When budgeting for your Part B expenses, note that there is no cap on the 20% that you will be responsible for paying. Because of the potential costs with no maximum out of pocket you can incur while on Original Medicare (Part A and B), it is important that you contact our advisors to help you find a plan to help defray these costs. The Part B costs above apply if your only coverage is Original Medicare (Part A and Part B). One way to lower your out-of-pocket costs is by exploring Medicare Advantage or Medicare Supplement plan options. Let our advisors do the research for you at no cost or obligation. Schedule a call.

What is the Medicare Part B premium?

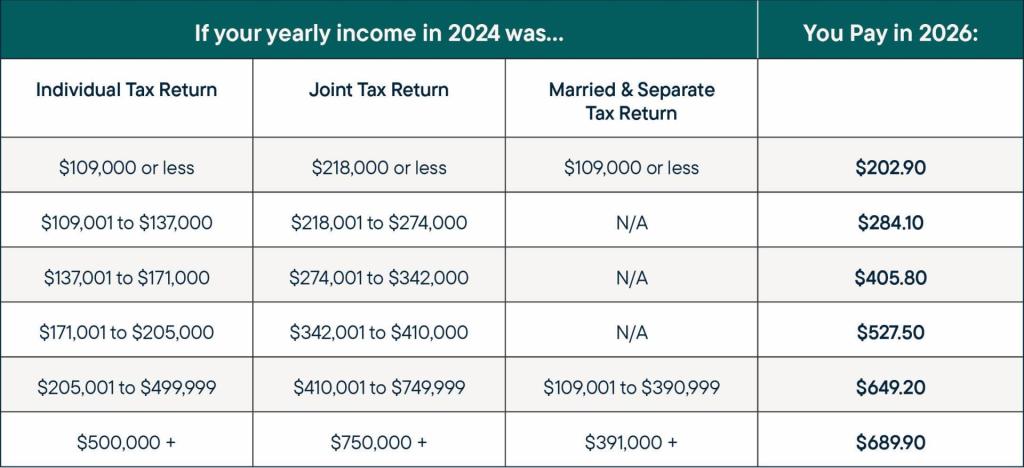

You pay a premium each month for Part B. For 2026, premiums start at $202.90 and increase depending on income. Most people pay the standard Part B premium amount. If your income is above a certain level, you will pay more for your Part B premium.

2026 Income-Related Part B Premium Adjustment Amounts

Medicare Part B Eligibility

Individuals must be a U.S. citizen or permanent legal resident for at least five consecutive years. You must also meet at least one of the following criteria for Medicare eligibility:

- Age 65 or older

- Are permanently disabled and have received disability benefits for at least two years

- Have been diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS or Lou Gehrig’s disease)

Original Medicare: Part A and Part B

Parts A and B are considered "Original Medicare." Medicare Part A covers inpatient care: hospitalizations, skilled nursing care, hospice, and home health care. The other part of Original Medicare is Medicare Part B, sometimes referred to as “medical insurance” and generally covers two types of medical services. First, it covers medically necessary health services and supplies, like outpatient hospital and doctor visits, tests, wheelchairs, walkers, etc. Second, Part B covers preventive services like screenings, annual wellness exams, etc.

Many individuals decide to enroll in a Medicare Part C (Medicare Advantage) or Medicare Supplement (Medigap) plan to provide extra benefits and fill in the gaps that are not covered by Original Medicare.

How to Enroll in Medicare Part B

If you are not automatically enrolled in Medicare, you can sign up for Part A and/or Part B via the online Medicare application, by calling Social Security at 800.772.1213, or by visiting your local Social Security office. If you are coming off employer coverage, you will want to be sure your Medicare effective aligns with the end of your other insurance coverage. Learn how to apply for Medicare Part B here.

No. Medicare Part B has an annual deductible, a monthly premium, and coinsurance for covered services. In 2026, the Part B annual deductible is $283, the standard monthly premium is $202.90, and coinsurance is 20 percent of the total cost of covered services. While most people pay the standard Part B premium amount, those who have an income above a certain level are subject to a higher monthly premium.

No. However, if you don’t enroll in Medicare Part B when you are first eligible, you may be subject to penalties. Your monthly premium can increase as much as 10 percent, for each year you could have had Part B but didn’t enroll. For example, if you didn’t sign up for Medicare Part B for two years after you were eligible, your premium would be 20 percent higher for life.

Potentially. If you’re eligible for Medicare, you are required to have creditable coverage or else you will be subject to a late enrollment penalty. Creditable coverage is any health coverage that is comparable to or better than what is available through Medicare. If you are on an employer group health insurance plan, check with your HR department to find out if your coverage is creditable.

When to Apply for Medicare

If you are turning 65, most people can apply for Medicare three months before their 65th birthday month. Signing up is different if someone has a disability or receives Social Security.

When you're first eligible for Medicare, you have a 7-month Initial Enrollment Period. If you are eligible for Medicare when you turn 65, you can sign up during the 7-month period that begins three months before the month you turn 65, includes the month you turn 65, and ends three months after you turn 65. We recommend contacting one of our experienced advisors for Medicare advice approximately six months before you turn 65. Learn more about working past 65 and Medicare.

Navigating Medicare Part B: Age-Specific Guidance

Medicare Part B plays an important role in your health coverage, but navigating its complexities can be challenging. This guide aims to simplify the process based on your age and situation.

- Confirm when you’re eligible for Medicare and if you qualify for early Medicare enrollment due to a disability or condition. Take our quiz to find out more.

- Get general Medicare education and answers to your questions by watching or attending one of our live or on-demand webinars.

- Learn about how and when to apply for Medicare.

- Need health coverage now? We offer individual health insurance plans to bridge the gap until you’re eligible for Medicare.

- Learn more about Medicare basics and download your turning 65 Medicare Checklist.

- Call or schedule an appointment with a RetireMed advisor to discuss your unique needs, plans for retirement or for working past 65, and other factors that will determine your specific next steps as they relate to Medicare and the enrollment process.

- Prepare for your appointment with RetireMed.

- Retirement isn’t a requirement to enroll in Medicare. If you’re working past 65, you have many factors to consider as you decide on your health coverage.

- Know specific steps to take and when with our checklist.

- Call or schedule an appointment with a RetireMed advisor to compare your existing coverage to Medicare.

- Navigating Medicare for a loved one can be overwhelming. Remember – we’re here to help answer questions and provide guidance!

- Find out when your loved one is eligible for Medicare and if they qualify for early Medicare coverage due to a disability or certain condition. They can take our quiz to learn more.

- Call or schedule an appointment for you and your loved one to meet with a RetireMed advisor to discuss your loved one’s unique situation.

Working Past Age 65 and Medicare Enrollment

Retirement is not a requirement for enjoying the benefits of Medicare. Many individuals aged 65 and older are delaying retirement and staying in the workforce. If you’re past age 65, you can sign up for Medicare regardless of your current employment status. Download your working past 65 & Medicare checklist here.

We make it easy to enroll in Medicare without retiring. Our advisors provide personalized guidance to help you choose the health plan that is right for you.

Questions? Your local partner in Medicare has answers.

If you have questions about your plan options or deferring Medicare Part B, contact our team of advisors in Dayton and Cincinnati.