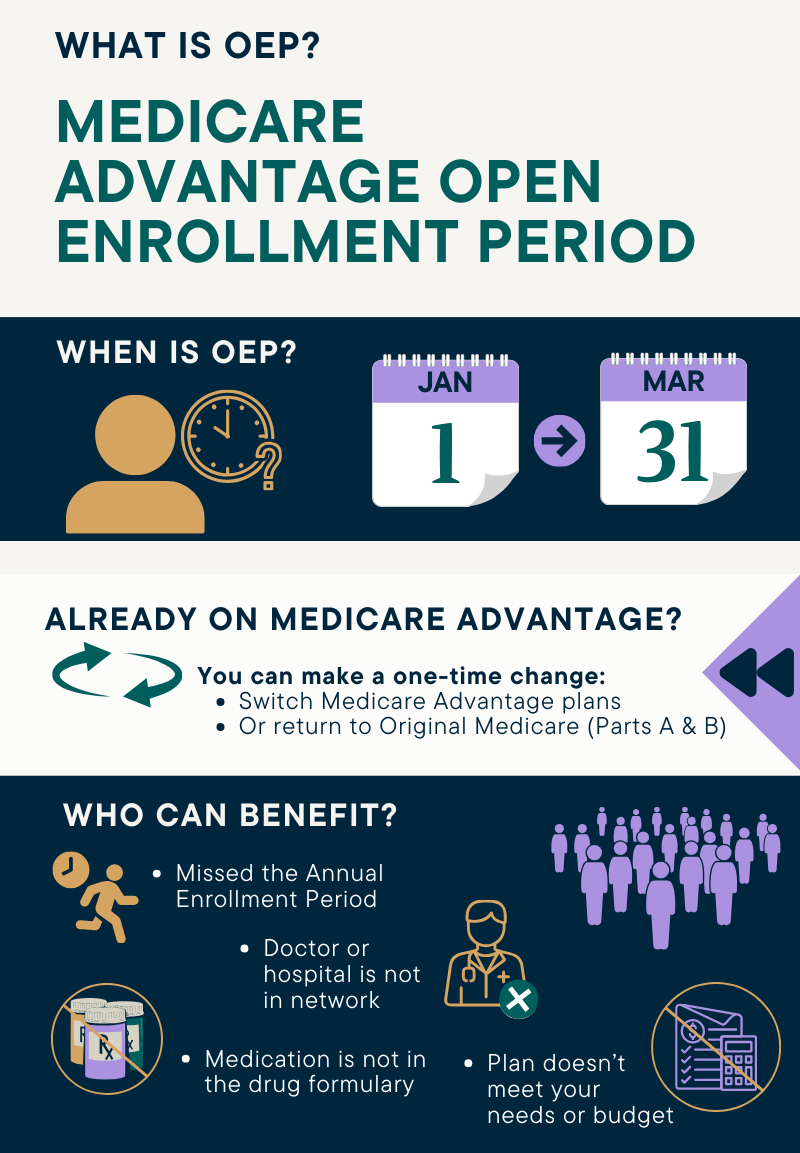

Medicare Advantage Open Enrollment Period

An opportunity to ensure your Medicare Advantage plan meets your needs.

What is the Medicare Advantage Open Enrollment Period?

Many people who are enrolled in Medicare are aware of the Annual Enrollment Period, which runs from Oct. 15 to Dec. 7 each year, when they can switch plans. However, those enrolled in a Medicare Advantage plan have an additional opportunity to make a one-time change during the Open Enrollment Period, which runs January through March.

For example, someone may have missed the Annual Enrollment Period and still wants to compare plans. Others may discover that their new Medicare Advantage plan isn’t the right fit—maybe a preferred doctor or hospital isn’t in network, or a prescription isn’t on the plan’s formulary.

Whether your current Medicare Advantage plan no longer fits your needs or budget, or you would like to change how you access your Medicare benefits, OEP is your chance to make a change.

Who is eligible for the Open Enrollment Period?

To be eligible to make a change during the Open Enrollment Period, you must already be enrolled in a Medicare Advantage plan.

What changes can I make during the Open Enrollment Period?

- Switch from one Medicare Advantage plan to another Medicare Advantage plan, with or without drug coverage

- Drop your current Medicare Advantage plan and return to Original Medicare (Part A and B only). In this case, you will also be able to join a separate Medicare drug plan

- You cannot change from one Part D prescription drug plan to another one during OEP

Your Expert in Medicare and Advocate for Life

We are here to provide the clarity you need to feel confident in your plan decision, and to ensure your enrollment is as easy and stress-free as possible. Licensed in Ohio, Kentucky, Indiana, and Florida, our team of local advisors is available to help find the right plan for your unique situation at no cost. We will:

- listen to your current health needs, priorities, and budget;

- research and compare your options from a breadth of plans;

- enroll you in your preferred plan;

- provide year-round support after enrollment—and for life; we're here as your go-to resource for any plan-related needs or questions.

Why RetireMed?

A trusted resource for guidance in Medicare for nearly 20 years, RetireMed has helped over 65,000 individuals in Ohio, Kentucky, Indiana, and Florida find the right health insurance for their needs. All our services are provided at no cost to you.

As a client of RetireMed, you'll have a team of advisors advocating on your behalf for all your plan-related needs, saving you time, money, and minimizing stress. Our services include:

- year-round access to our support team to help you navigate billing or claim issues and answer questions regarding your coverage, benefits, and prescription costs;

- proactive plan reviews to optimize your benefits and ensure your plan continues to meet your needs;

- timely communications to keep you informed of any upcoming plan changes, newly available resources, or important updates from your health insurance company;

- and so much more.